How to get €16K compo from this insurance company without really trying

Pasted below is a ‘compensation offer’ letter from a leading Irish motor insurance company which exposes the industry’s ‘compo culture’ double standards!

Last Friday week was a typical day at our law office here in the heart of Ballyfermot.

A typical day, in that it was a busy day – trying to catch up with stuff and missed calls etc etc before the weekend.

One of those missed calls, apparently, was from a chap from one of Ireland’s largest motor insurers.

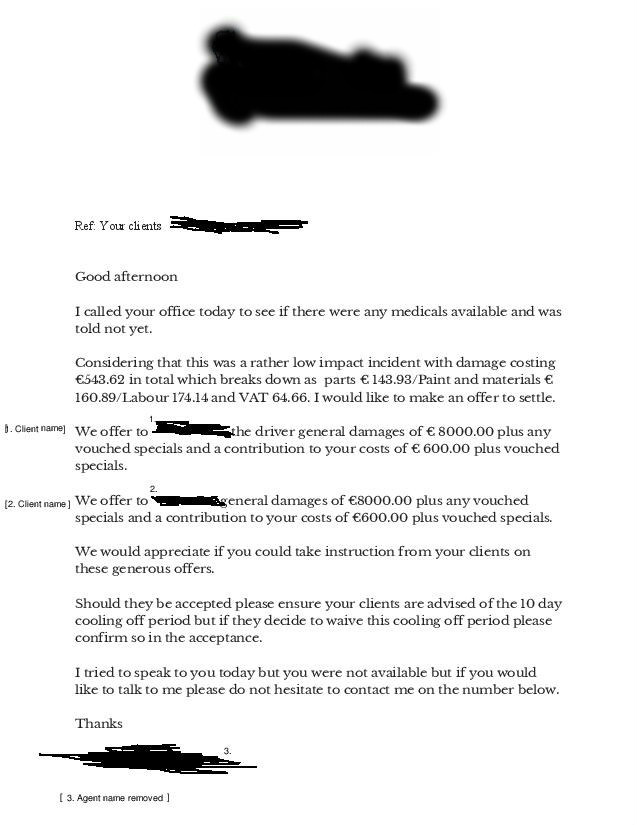

I know that now because this piece of mail below arrived in later that same day. It was an offer of compensation settlement for two clients of our’s who were in the same road traffic accident.

So what? you say?

Well no it’s not unusual, but in an unusual step, I have taken the liberty of reproducing that letter right here for public view on this web page.

Read it and see first what you think… and below same I will tell you what I think.

[We have redacted persons’ names of all concerned but otherwise it is published in full.]

Now before I tell you what I think about the above, let me give you the backstory (no pun intended!).

The Backstory to the Case

My firm (Quinn Solicitors) took on a case representing a couple who were involved in a traffic accident in County Kildare back in mid-July 2016. Another car had collided into their own stationery vehicle from behind whilst they were stopped at traffic lights.

They both reported soft tissue back, neck and shoulder injuries – one of the pair apparently somewhat worse off than the other.

Nothing to see here…what’s so unusual about case?

Nothing! These injury types are commonplace when road traffic accidents occur.

There is also nothing unusual about receiving a ‘doorstep’ settlement offer from an Irish insurance company like the one above…

…but it is disgraceful!

It is disgraceful for the following reasons;

If you read the above offer of compensation carefully you should have noticed that this insurance company were trying to settle a claim before any medical examination records had been provided.

In other words they made an unsolicited offer to pony up compo for alleged whiplash/soft tissue injuries to two individuals without any medical evidence whatsoever! And this happens all the time!!

There are two obvious ramifications here;

- Encouragement of a claims culture: Imagine if you are having a jar with your mates in the local pub. This time you have no problem standing your round

– because you have just received eight grand into your arse pocket. You tell them that you got it in jig time for a whiplash claim without even having to get a doctor’s report. Maybe your friends are honest (and most people are in my professional experience) but don’t you think there is an obvious moral hazard here?

- A bad deal for genuine claimants: What if your injuries transpire to be worse than you thought? What you might have thought to be minor could eventually be diagnosed as far more serious and long-lasting, but once you have accepted the insurance company lowball offer, you’re effectively screwed! Furthermore if at any time in the future you have another similar injury claim, the latter would be badly compromised by the fact that you did not have a verified medical report for the first one.

In the UK they are now banning insurance companies from engaging in this sort of activity. UK Justice Secretary Elizabeth Truss has proposed measures including;

“banning offers to settle claims without medical evidence. All claims would need a report from a MedCo accredited medical expert before any pay out [sic].”

Despite intense lobbying by insurance companies in the UK to blame the legal profession, they effectively got hoisted on to their own petard when the their own shady practices got exposed (this included selling claimant ‘leads’ to legal firms).

Insurance Ireland blows its PR Engine

Perhaps mindful of their setback across the water, Insurance Ireland (the lobby group whose member companies are largely owned by British parent operations) have been on a major PR campaign to focus the blame on the legal profession for their swingeing 70%+ car premium increases.

This has had some success with many in the Irish media taking the bait – hook, line and sinker! For example I recently called out Charlie Weston (the Irish Independent personal finance hack) for not getting to the real story (ref: this article he penned which must have delighted the insurance industry no end).

I subsequently wrote a letter of riposte to the Indo which they did not publish but happily it did feature in the December issue [PDF] of the Law Society Gazette.

My letter’s publication in the Gazette criticising Charlie caused a minor shit storm in some circles at the time (and indeed so might this article!) but I don’t mind too much. My loyalty is not just to my clients or profession at any cost but to our code of professional ethics and to the truth as I see it.

I would also submit that the truth is now plain for everyone to see in that ‘compensation offer’ we have published above.

All that said however, it is a nice reassuring touch for that chap from the insurance company to remind us that we have this ten day ‘cooling off period’…notwithstanding two weeks’ later my blood is still boiling!

POSTSCRIPT: We are not alone in in the legal profession in calling out the insurance industry and their methods. See also;

Accepting first offers from Insurance companies or Injuries Board | Lawyer.ie

Personal Injury Legal Costs & Rising Car Insurance Premiums: 4 Myths Busted! | Carmody Moran

Recent Comments